what is the sales tax rate in tampa florida

The 2018 United States Supreme Court decision in. Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on.

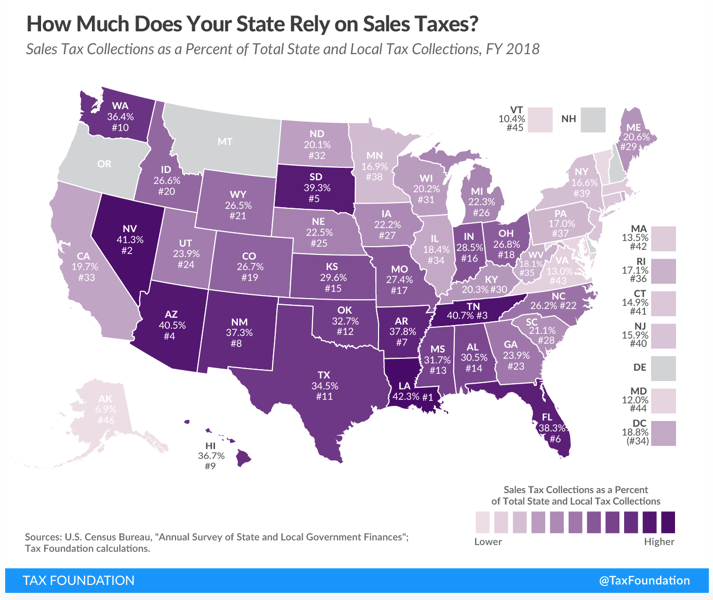

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

This is the total of state county and city sales tax rates.

. FL Sales Tax Rate. The estimated 2022 sales tax rate for 33629 is. The minimum combined 2022 sales tax rate for Lutz Florida is.

Floridas general state sales tax rate is 6 with the following exceptions. The Hillsborough County sales tax rate is. Groceries and prescription drugs are exempt from the Florida sales tax Counties and cities can.

Hillsborough County sales tax. However there are some counties that do not impose surtax. Hillsborough County sales tax.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The Hillsborough county and Tampa sales tax rate is 75. Additionally some counties also collect their own sales taxes ranging from 05 to 25 which means that actual rates paid in.

The Tampa sales tax rate is 75. Florida state sales tax. Floridas general state sales tax rate is 6 with the following exceptions.

The state sales tax rate in Florida is 6000. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. The Florida sales tax rate is currently.

The current total local sales tax rate in Tampa FL is 7500. The County sales tax rate is. The statewide sales tax rate in Florida is 6.

The 2018 United States Supreme Court decision in South Dakota v. The Tampa sales tax rate is 75. While Florida has a sales tax of 6 the actual sales tax for a vehicle in this state depends on the exact city you are in.

Florida has state sales. 3 rows Tampa collects the maximum legal local sales tax. The tax landscape has changed in the Tampa area.

The Florida state sales tax rate is currently. 4 rows Tampa. Average Sales Tax With Local.

The discretionary sales surtax rate depends on the county where rates currently range from 5 to 15. This includes the rates on the state. 31 rows Plantation FL Sales Tax Rate.

Local governments can collect up to 15 additional sales. Pompano Beach FL Sales Tax Rate. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

For several years the state reduced the commercial rental sales tax rate small amounts with a reduction to 55 plus the local surtax effective January 1 2020. Florida state sales tax. This is the total of state and county sales tax rates.

Has impacted many state nexus laws and sales tax collection. The 75 sales tax rate in Tampa. The sales tax rate in Tampa Florida is 75.

That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. With local taxes the total sales tax rate is between 6000 and 7500.

Florida Vehicle Sales Tax Fees Calculator

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

Florida Ranks 6th In Nation For Heavy Reliance On Sales Tax As A Revenue Source Fernandina Observer

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Overcharged Some Hillsborough Businesses Slow To Lower Sales Tax Rate

Amazon Starts Charging Sales Tax In Florida May 1 2014

Hillsborough County Transportation Surtax Tampa Bay Lgbt Chamber

Florida Vehicle Sales Tax Fees Calculator

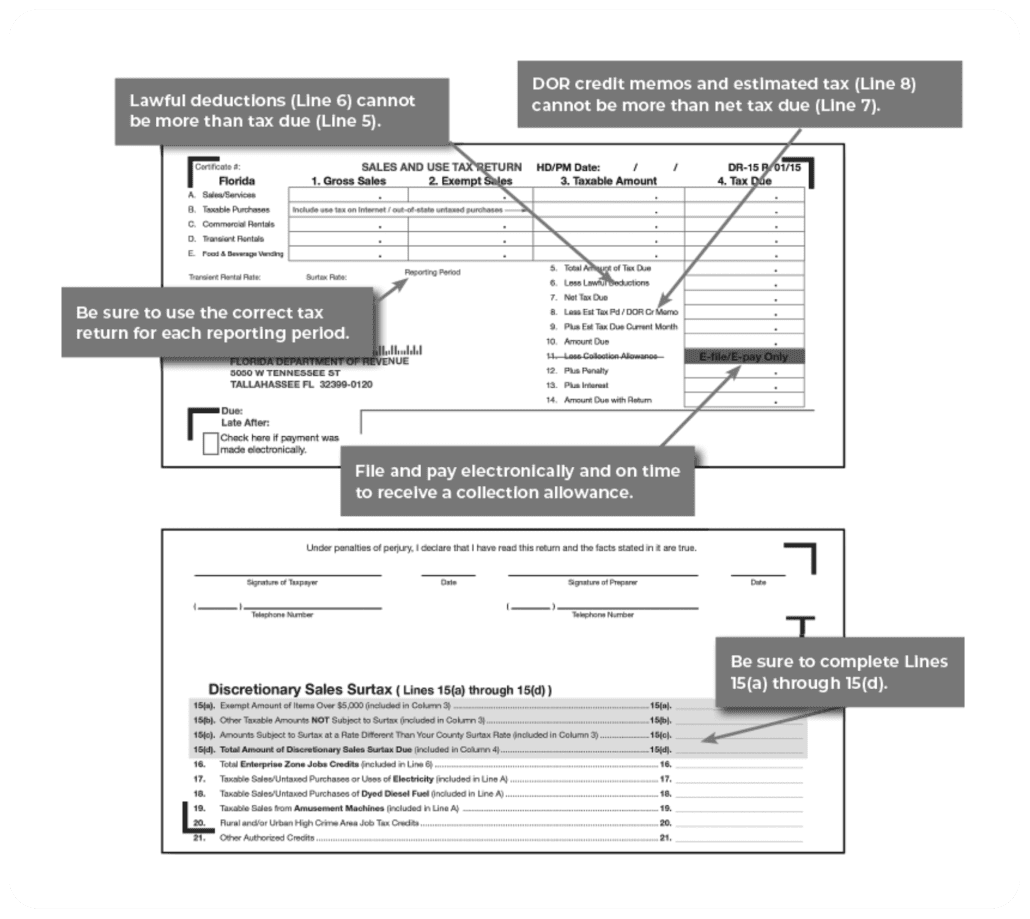

Florida Sales Tax Small Business Guide Truic

What Is Exempt From Sales Tax In Florida

Tampa Bay Referendums Include Public School Funding Transit Tax And Environmental Land Protection Wusf Public Media

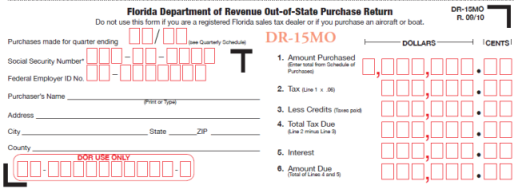

How To Report Florida Sales Tax Xendoo

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

2022 Tax Free Weekend In Florida For School Supplies July 25 To August 7

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Determining Florida Sales And Use Tax For Contractors Marcum Llp Accountants And Advisors